34+ deductible home mortgage interest

Even if you didnt get your home mortgage interest deduction on Schedule A because you didnt have enough itemized deductions to exceed your standard. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Web 1 hour agoOn Jan.

. Homeowners who bought houses before. Compare offers from our partners side by side and find the perfect lender for you. Web Home deductible Images insurance mortgage.

For taxpayers who use. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Home Mortgage Interest Deduction Deducting Home Mortgage Interest Mortgage Interest.

Some interest can be claimed as a deduction or as a credit. 13 1987 your mortgage interest is fully tax deductible without limits. Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US.

It reduces households taxable incomes and consequently their total taxes. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Web The home mortgage interest deduction currently allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal. Web 34 deductible home mortgage interest Selasa 21 Februari 2023 Edit. 34 mortgage insurance tax deductible Senin 20 Februari 2023 Edit.

There are also differences in costs for men and. Also if your mortgage balance is 750000. Web In this video we demonstrate how to read Form 1098 and how to enter the information into TubroTax in order to take itemized deductions for home mortgage inte.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Is Pmi Tax Deductible Credit Karma Free 34. So if you were dutifully.

The place is catalogued as Civil by the US. Board on Geographic Names and its elevation. Ad Calculate Your Payment with 0 Down.

Web If you took out your mortgage on or before Oct. Interest is an amount you pay for the use of borrowed money. Web Enter your address and answer a few questions to get started.

Web So if you have one mortgage for 500000 on your main residence and another mortgage for 400000 on your vacation home you cant deduct the interest. Web The cost of Plan G varies widely depending on where you live there are many Medicare plans available in the Fawn Creek area. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. This deduction is capped at 10000 Zimmelman says. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

The finalized worksheet to correctly calculate the mortgage interest. Households claiming the home mortgage interest deduction declined. Web Web During this time Stock Yards Bank has held up forward progress by.

Ad Increasing Mortgage Payments Could Help You Save on Interest. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The Township of Fawn Creek is located in Montgomery County Kansas United States. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web IRS Publication 936. Yes essentially you are running into the same situation. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. February 12 2022 808 AM. Web Topic No.

11 2023 the IRS announced that California storm victims now have until May 15 2023 to file various federal individual and business tax returns and make. Web Taxpayers who took out a mortgage after Dec.

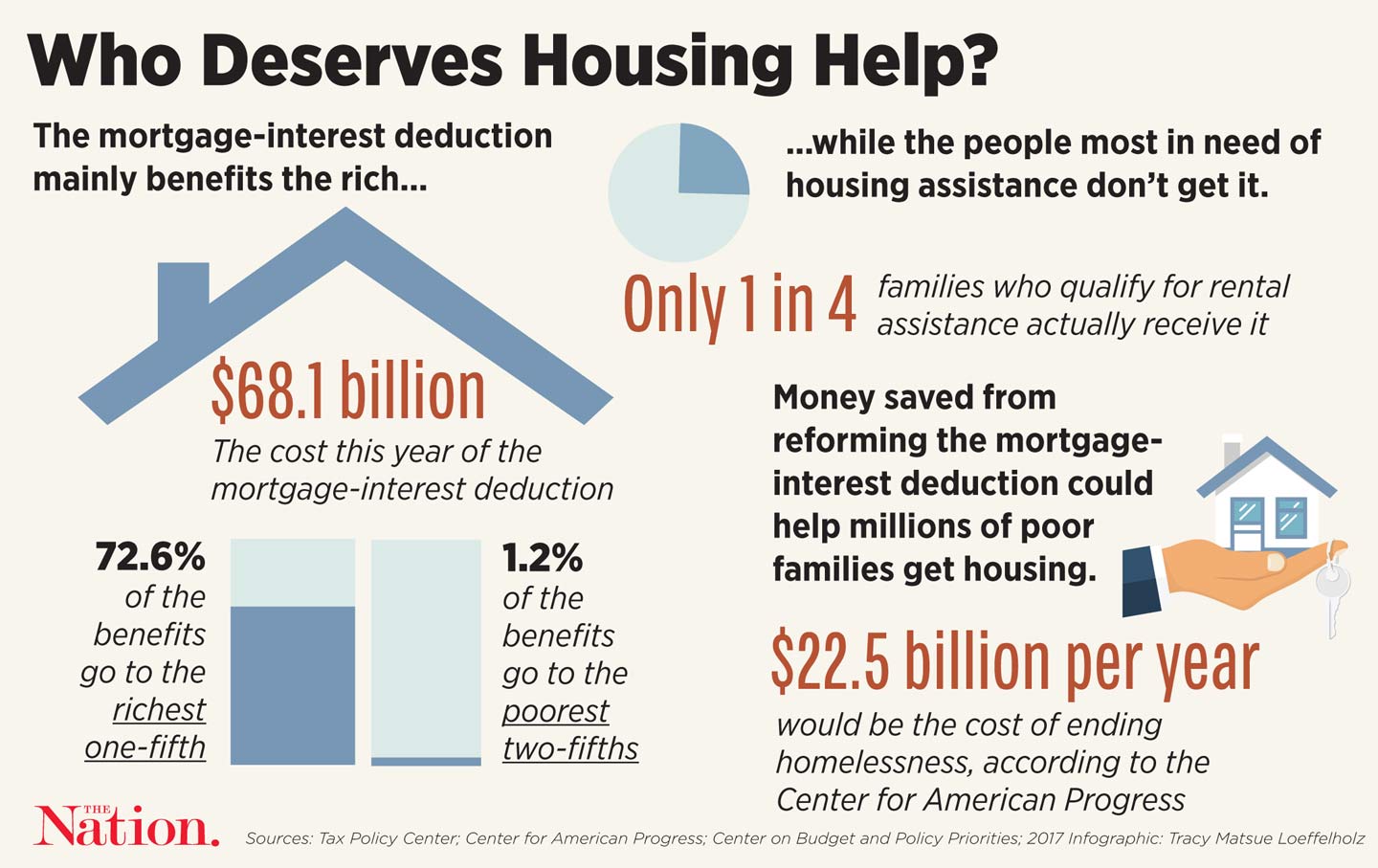

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Race And Housing Series Mortgage Interest Deduction

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Rules Limits For 2023

Home Mortgage Loan Interest Payments Points Deduction

11660 St Hwy 125 Bradleyville Mo 65614 Mls 60233358 Movoto

Mortgage Interest Deduction Save When Filing Your Taxes

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Start Learning From Best Platform I Online Programs For Professionals Wagons

Gentrification And The Affordable Housing Crisis The Responsible Consumer

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center